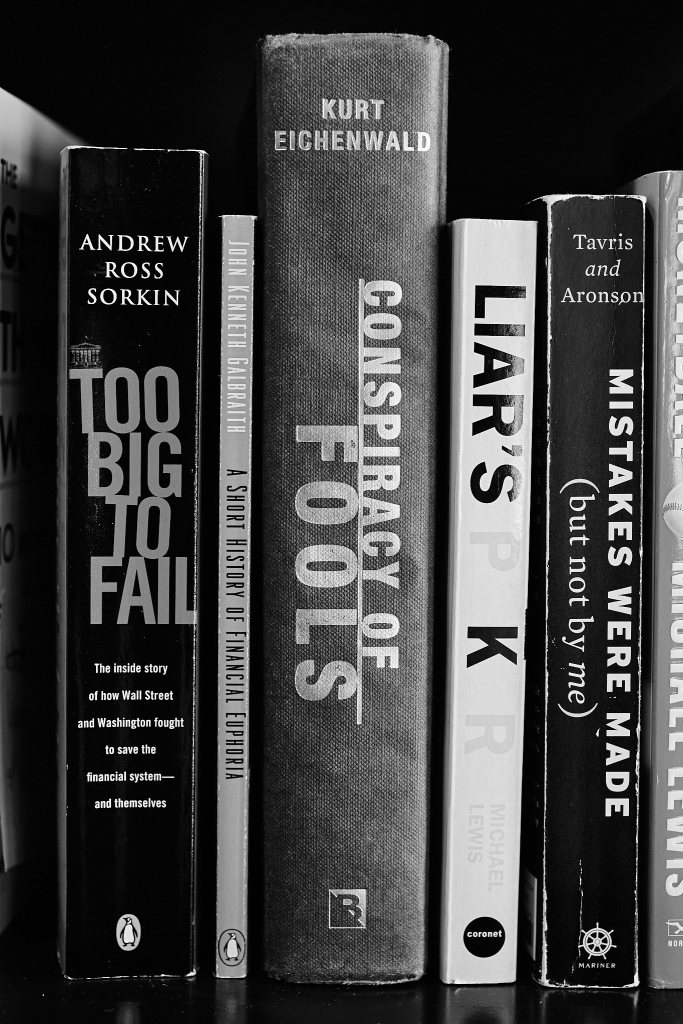

What’s in your library?

It’s important to consider past failures. The seeds of a future crisis or firm failing have already been planted. Thankfully there are some good books to remind us just how quickly firms and markets can collapse. If you can avoiding just one instance of these mistakes, your skills will command a premium!

Sometimes its the whole financial system that creates the conditions for failure resulting in the catchphrase “Too Big to Fail”. Sometimes it can be just one firm, as aptly described in the great book “Conspiracy of Fools” – the story of Enron.

One of the first recorded financial crises was ‘Tulip Mania” in 1630? Described in J. Kenneth Galbraith’s “A short history of financial euphoria”, it explains the risks that come from holding an investment only for the purposes of speculative return and for losing sight of the fundamentals. Compounding the problem was LEVERAGE – which enabled people to borrow to engage in the speculation. At the height of the mania, a prized tulip could be worth $300,000 to $1 million in today’s money.

Hindsight is 20/20 – so obviously today none of us would be gullible enough to invest in tulips would we? But think through every other speculative bubble that has occurred since then. Always remember the risks of LEVERAGE and the risk of losing pace with fundamentals. Should a tulip be more expensive than a horse or a house?

Some of the crises were driven by deregulation or innovation and the pitch that the future is now very different from the past – so much so that the old fundamentals are no longer valid. Think about the Dot.com boom and collapse.

There are too many examples to list here. Enron (2001) & Lehman (2008) immediately come to mind – but so too are more recent names like WeWork(2023). A digital rebranding of classic ‘bricks and mortar’ real estate, WeWork had a ‘valuation’ of $47bn before falling substantially.

The last book in this picture “Mistakes Were Made but not by ME” has a humorous title. It explains how, operating withing the system, we can end up justifying our own actions. Enron is also described in this book. It can be very hard to change the system from within.

If you prefer videos, both Enron (The Smartest Guys in the Room) and Barings (staring Ewan McGregor) are both highly entertaining and illustrate that those at the top sometimes have no clue has to how abnormal returns are being made. If there is one takeaway here – it is to Challenge Success. Sadly, in the case of both movies, those that challenge success are either not listened to or jettisoned (the pre Wistleblower era).

“When Genius Failed” by Roger Lowenstein (not pictured) is one of my favorite books. This is worthy of another post – but describes the admiration Wall Street had for LTCM and their collection of intellectually stellar leaders. Wall Street fell over itself to faciliate the transactions that LTCM wanted to make, providing massive leverage. Turns out leverage, speculation and prior ‘historical correlations’ don’t always predict the future. The Emerging Markets Debt Crisis and Russian Default blew the doors off the historical correlations that LTCM was dependent upon.

What reminds you of the potential for risk and keeps you grounded? What’s in your library?