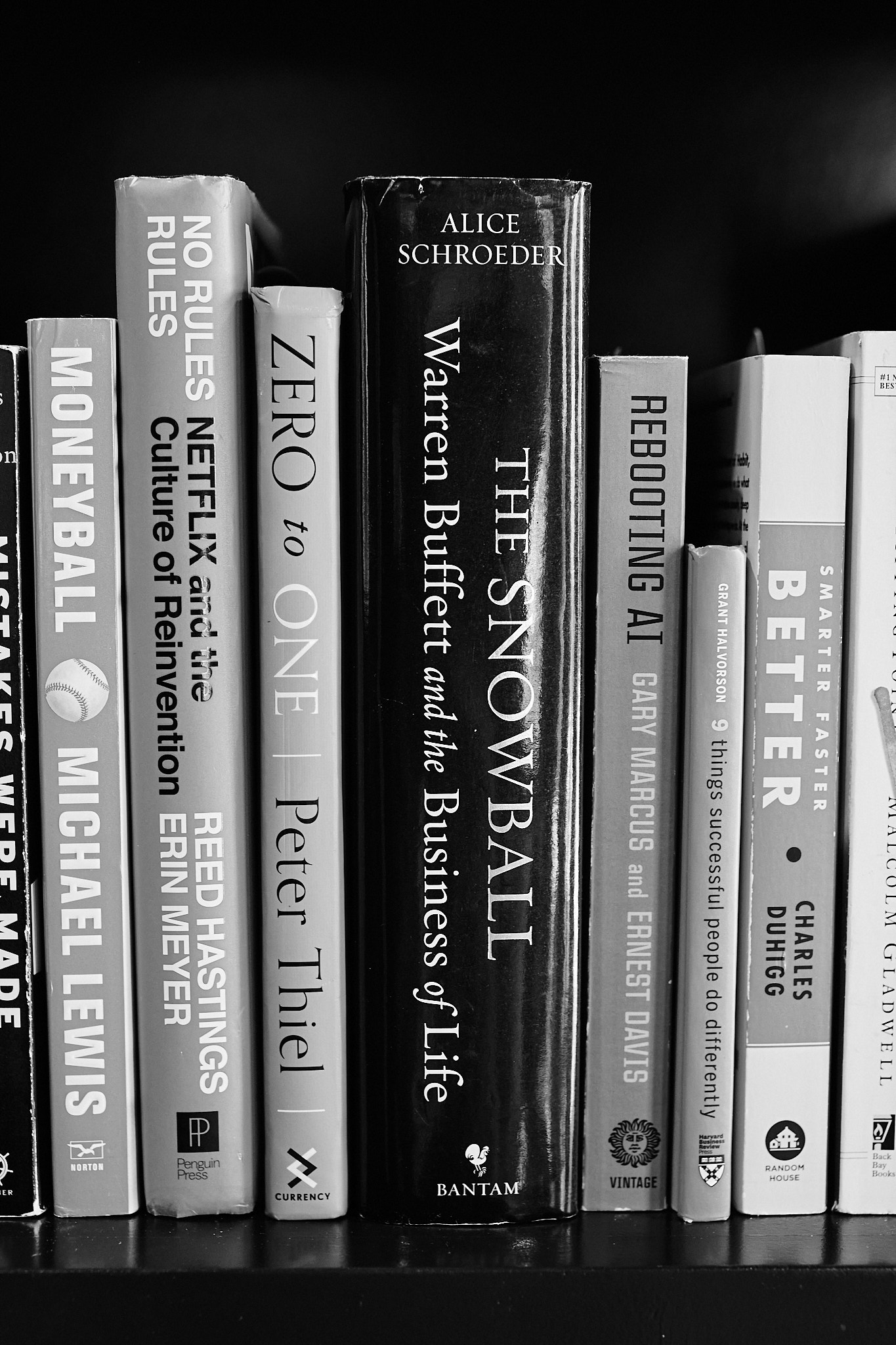

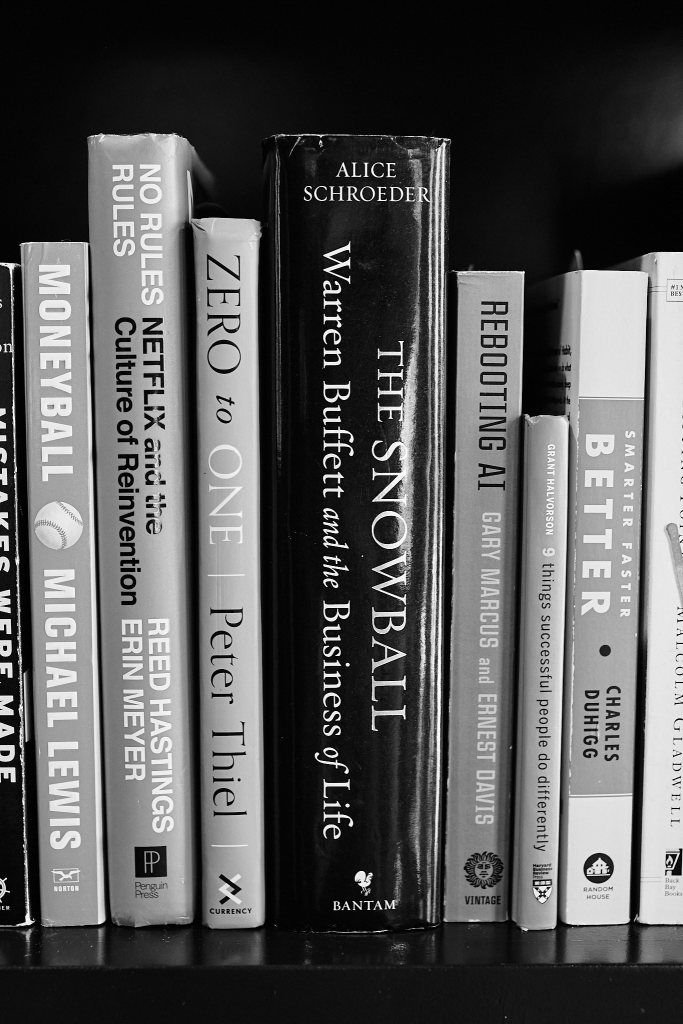

What’s in your library?

Part 1 of this series focused on key stories of ‘what went wrong‘. Now let’s look at some books which focus on how to get it right.

First up – Money Ball – by Michael Lewis which chronicles how a baseball team with a non stellar budget can produce outsize returns. The trick is to decompose performance into its constituent parts and pay appropriately. No one person may be perfect, but a team could be. The old method of gut feel talent scouting was replaced with data driven approaches model. I like this because it reminds me of fundamental value – and I love to crunch numbers!

2. Netflix and the culture of reinvention is about winning and staying competitive. How much should you bid for that next TV series? Sometimes legacy metrics or comparisons don’t cut it. I especially like the part about raising peoples salaries rather than letting your good talent get poached.

3. Zero to One by Peter Thiel. I took away 2 things from this. Firstly diversifying your portfolio equally across 100 investments will never deliver outsized returns. That’s because the 1% invested in the asset you got right – simply doesn’t have enough weight to make a difference in your overall portfolio. Do your research, and make an investment that will make a difference to your aggregate returns. Yes – its ALL IN – in a smaller basket of hand picked stocks! (Disclaimer – I am not providing investment advice)

The second lesson – you need to build your business for scale – design out those manual process steps. Think about the last Amazon transaction you made. At what point was a human engaged in the process? Probably very few points of human engagement. And when was the last time something went wrong with that? You get my point – design for scale. A lot of businesses don’t! Often I’ve seen ‘controls’ as a bolt on – or after thought. We need to design controls for scale – without human involvement.

4. Snowball – Warren Buffett and the Business of Life – this is a long read but enjoyable. Be a long term thinker, enjoy the power of compounding and focus on what you understand. Create routines for continuous learning. There a lot of companies in the Berkshire Hathaway portfolio that are boring but well managed and good. Boring and good is good!

5. Rebooting AI is a cautionary tale, written in 2019 exposing the hype versus reality of AI. Training AI on biased, or wrong data simply leads to bad AI. I like the story of how Roomba for all its sophistication really can’t differentiate between dog poop and breadcrumbs. As a family with 3 dogs we are very careful when we release our Roomba! However AI has come a long way in 5 years – so I realize that I’m overdue for a new read in this area. Recommendations appreciated!

6. Nine things successful people do differently by Heidi Grant Halvorson is a very compact Harvard Business Review book. I like to re-read this from time to time. Success isn’t about innate talent or luck but by about adopting deliberate habits. One of the key takeaways is on goal measurement. Successful people measure themselves on how far from the goal they remain – not on how far they have come. Know exactly how far you have to go. Focus on getting better, not being good.

7. Smarter Faster Better by Charles Duhigg. This book describes 8 key principles that drive productivity and success in individuals and organizations. There’s a great story about Quantas Flight 32 engine failure and how preparing ahead of time for worse case scenarios really helps. There’s a lot in the book including data driven approaches and goal setting (combining stretch goals with SMART goals).

What books remind you of businesses who thrive and who successfully manage risks?

What’s in your library?